How to find the suitable cheque deposit machine

The modern bank has evolved from the conventional concepts of banking, and it has accepted current practices. Every bank has to deal with a lot of money regularly, and it does need to be precise as mistakes in calculation can create a problem for the bank. Digital equipment has made the work of banks a lot more convenient and efficient as calculations and other tasks such as counting and check the positions have been made suitable and precise with the involvement of digital gadgets.

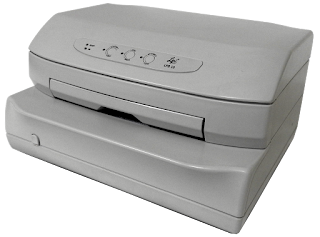

Cheques have always been a great concern for the bank, as cheques are associated with transactions of more significant amounts. In such situations, if the deposition machine might not be working very precisely, it can create great trouble for the bank as there might be an obstacle in the transaction. Cheque the partition machines have been top-rated in today's date.

Features of a kiosk machine

Most banks prefer having a kiosk machine with themself because it provides the bank with multiple numbers, features and benefits, which make the entire transaction a lot more convenient. The first significant benefit of having cross-machines is that they are highly accessible. It provides multiple options to the account holder, and it makes the ATM multifunctional.

The second significant benefit is associated with the security purpose. Everyone understands how important security is around money, and this is the exact story of the kiosk machines as well. This machine is healthy in the detection of duplicate and fake cheques conveniently, and it instantly blogs the sender and informs the back office. It helps in stopping real-time fraud and maintaining a proper balance.

Why do banks prefer automated machines instead of conventional methods?

Most of the banks in today's date happily appreciated the entire development of Technology, which has been happening worldwide. Proper usage of a kiosk machine makes the whole transaction a lot less problematic and makes it easier for any customer to make cheque transactions. The chances of finding an error are entirely reduced with the usage of the technological machine as it constantly keeps the check up on all the different factors and makes sure that most of the transactions are risk-free.

How to pick the right supplier?

Picking the right supplier would help the bank with a proper kiosk machine is very important. The first factor which the bank needs to be super careful about is if the supplier is associated with multiple brands or not. It is always advisable to go for a supplier associated with a single brand as it provides a lot of guarantees upon the quality of the machine which the person would be receiving.

The machine needs to have superior quality as problems during the transaction can create problems for the bank, and having a superior quality machine reduces multiple problems. Picking up the right cheque deposit supplier might not be a very difficult task. Still, it does require a little bit of research for the bank to define the most accessible and reliable supplier of the kiosk machine.

These are the different factors which the bank should consider and understand before taking up a supplier for their kiosk machine. Picking up the right cheque deposit supplier makes the entire process a lot more convenient and easier.

Comments

Post a Comment