Significant Advantages of cash deposit machines

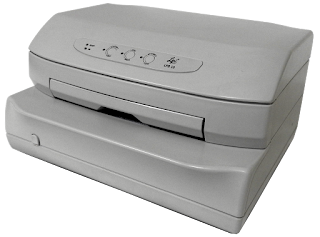

Doing a cash deposit is always nerve-wracking for a person. There are a large number of ways by which a person can make cash deposits. The deposit machine is an ideal choice for making a large number of deposits. It is very easy to handle because the deposits can be made in advance. It can be done either by completing the slip or by using an app. A person can make a cash deposit by using banknotes. It only takes 30 seconds for a person to do so.

Economy and reliability

The cash deposit kiosk machine is quite suitable for making a cash deposit. Making a cash deposit in a machine generally reduces costs and also lowers the work for the bank. It is quite simple, and it's good mechanism usually reduces the break-downs to an average of less than one per year. These machines generally have a secure transport service which thereby makes them quite safe.

There are a large number of ATMs, and all they provide is only cash withdrawal. These cash deposit machines will work as two in one, i.e., both cash deposits and a cash withdrawal.

Advantages of these machines

They are Highly Accessible

A company can also make a host of cheque deposit options available to the account holders in the machines. This will thereby increase their functionality.

There will be no Duplicate notes and checks.

Now the new cash deposit kiosk machines usually recognize the duplicates instantly and send alerts to the back office so that the bank will know about them. It will also ensure that the company blacklists fraudsters.

No More Exceptions

The machine will also have CAR/LAR, image quality, usability assurance, automatic re-orientation, and our Intelligent Repair Image System. This will be of great help because it verifies as well as repairs the image.

It will take control of nearly everything.

A person or a company can easily manage what features can be accessed at the ATMs. There are many machines in which a person can easily change its settings through the comprehensive administrator profile to maintain the security of the ATMs.

The Fake Cheques that will be deposited will be Caught Early.

Nowadays, the ATM uses Positive Pay to provide real-time fraud detection. It will alert the bank or the financial institution when a fake check is detected in it.

It will Balance Less.

The financial institutions, as well as the banks, can now balance multiple transaction types. They will also have the option to balance in various ways that best fit with the business operations that they will carry out.

Conclusion

The Automated Teller Machines have therefore played a key role in redefining a bank. ATMs Cash Dispensers have turned into an efficient and effective channel in ensuring customers can bank at their convenience all over the world.

Comments

Post a Comment