The wave of revolution with self-service machines

Over the years, the Indian banking industry has been transformed, changing its structure and functions. The banking industry has grown and changed from social banking to a liberalized, modernized and technology-oriented sector.

In recent years, banking has undergone a big transition. Modern banking has adopted technology due to rising customer demands, legislation, economic shifts and constant competition. The self-service terminals in banking and digital networks & payment banks have revolutionized the industry significantly. Digital India has also provided the much-needed impetus for the bank's digitization efforts.

With the growing digitization and tech interruption, an integral component of smart banking is artificial intelligence. By learning what clicks with customers, banks broaden their customer base. AI cognitive technology can include cognitive interaction, automation, and a support system built through AI that targets the user's interests, reduces human involvement, collects data patterns, and develops strategies. The self-service terminals in banking also use similar tech inventions.

Today, banking no longer means "going to the bank" and standing in lines. But now it is about transacting wherever your customers choose and whenever they want. In addition to digital and mobile banking options, transactions on ATMs are fast and straightforward. The self-service terminals in banking have enabled freeing up your tellers' time for banks so they can spend more of their energies on high-value activities.

Clients empower to leverage these automated machines' resources and make smaller branches a reality of doing more by themselves. Enhanced consumer service with reduced operating costs and expanded capital devoted to new and improved sales of services. This movement can change the viability of a bank network. It provides a unique mix of powerful features that change the way conventional banking services are provided.

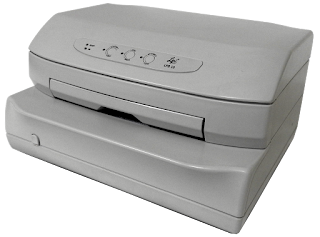

Today's self-service kiosks are the perfect combination of classic vending machines and sophisticated peripherals with high-tech communications. Such interactive kiosks can include self-checkout lanes, e-ticketing, finding information, paying bills, and other sales. As consumers incorporate technology in their everyday lives, digital kiosks like self-service terminals in banking have become a more significant part of the retail landscape.

The kiosks and terminals Accelerate banking and customer onboarding transactions by encouraging the customers through their chosen method. It is doubtful that today's mobile-first customers would have the patience to stand in line at a branch, enter data frequently or wait days to approve an application. The pace and intuitive options for self-service banking transactions were long needed to please clients.

Also read:- 4 reasons why line matrix printers are best for today's businesses

Comments

Post a Comment